I think these high-yield UK stocks might deliver a winning second income for years to come. Here’s why I’d buy them if I had spare cash to invest today.

Legal & General Group

Tough economic conditions pose a threat to earnings at life insurers like Legal & General (LSE:LGEN). When consumers feel the pinch, spending on non-essential financial services often slumps.

Yet I don’t think this will affect dividend growth at this FTSE 100 firm. This is thanks to its excellent cash generation and, by extension, the firm’s rock-solid balance sheet.

The company is on course to generate between £8bn to £9bn of capital in the five years to 2024. It should therefore have the means to pay big dividends, even if profits disappoint. So weak dividend cover of between 1.1 times and 1.3 times isn’t a gamechanger for me.

Besides, I’m someone who buys UK shares based on the returns I can expect over a long time horizon. And over the next decade I’m expecting my Legal & General shares to deliver handsome rewards, as what my Foolish colleague Mark Tovey refers to as a ‘grey tidal wave’ approaching.

The size of elderly populations across its global territories is set to surge in the coming decades, meaning that demand for life insurance policies, pensions, annuities and wealth products will follow suit.

Today, Legal & General carries an enormous 9.7% dividend yield for 2023. It also trades on a rock-bottom forward price-to-earnings (P/E) ratio of 9.3 times. I think these numbers make this industry giant too cheap to miss.

The PRS REIT

Purchasing real estate investment trusts (REITs) could be another good idea for these trying times. This is thanks to the reliable rental income they tend to receive that forms the bedrock of their generous dividend policies.

These companies are obliged to pay at least 90% of profits from rental operations out in the form of dividends. And residential landlord The PRS REIT (LSE:PRSR) is one such operator on my radar today.

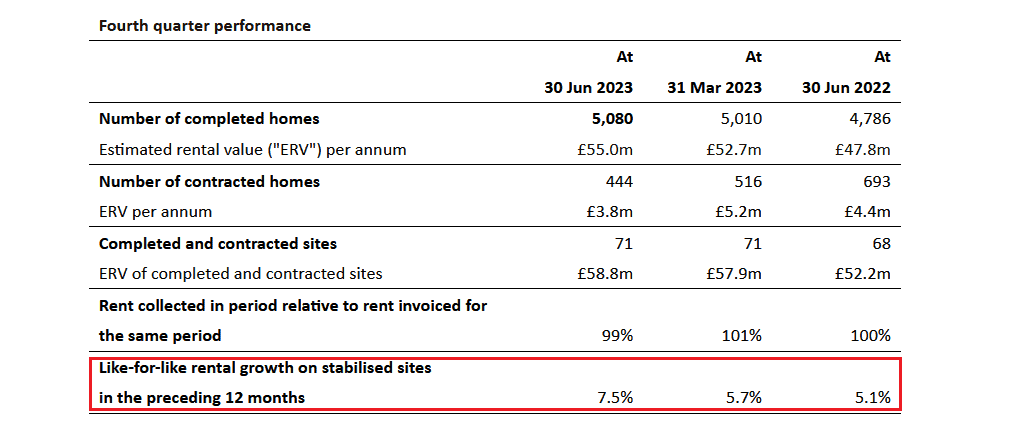

Rents are soaring at companies like this as homes supply in the UK worsens. Like-for-like rental growth at this small-cap company is accelerating, as the table below shows.

Rents are soaring due in large part to a steady outflow of buy-to-let landlords. The number of properties on the market is dwindling as increased tax liabilities, changing regulations and higher day-to-day running costs cause investors to sell up.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Things could get a lot worse too if the Renters’ Reform Bill (which aims to end no-fault evictions) passes through parliament. A whopping 54% of landlords recently told a Simply Business survey they would consider quitting the sector if the new law comes in.

At the same time, there is no sign that weak housebuilding activity is set to pick up. So despite the undeniably large impact of rising build costs, I’m still expecting PRS to deliver healthy profits growth for the foreseeable future.

Today, the company trades on a low price-to-earnings growth (PEG) ratio of 0.7 for this financial year. Meanwhile, its dividend yield stands at 5.5%.

I think it’s a good, low-cost way for investors like me to build a second income.